Pricing

Break-even point

Setting your price can be a tricky thing to master; the way you work it out is going to be different if you are a service-based organisation to a product-based organisation, however as a starting point both involve calculating your breakeven point, which I will go through with you shortly.

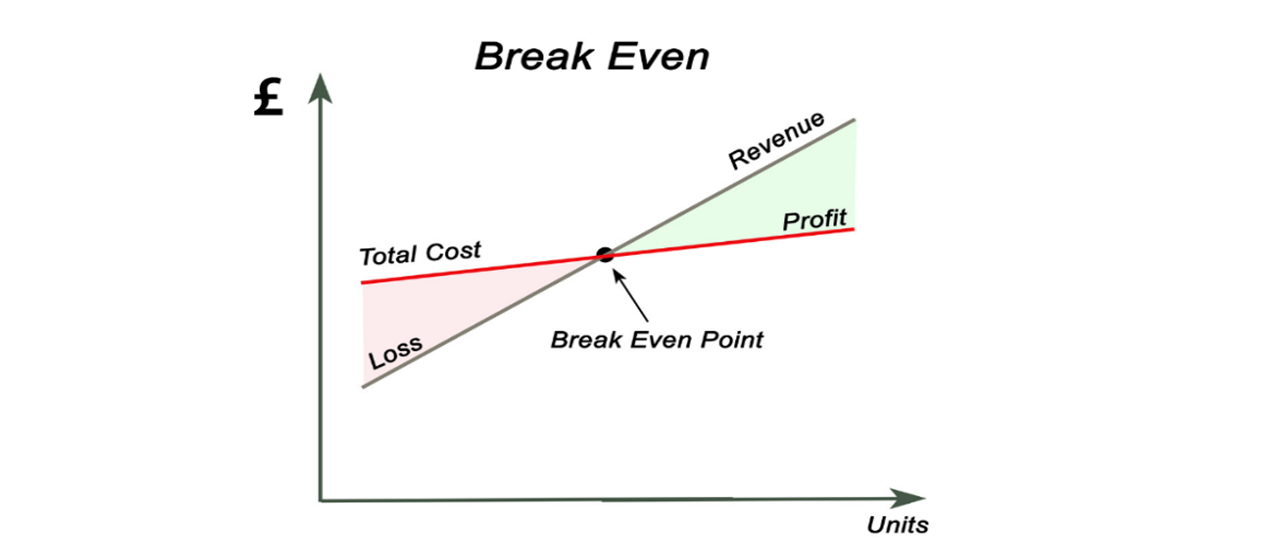

The breakeven point is a level (in hours or units) where total income equals total expenses. Once you have reached the number of hours or units you will then be making a profit, if you do not sell enough to reach your breakeven point you will be trading at a loss, so it is a really useful calculation to do to give you an idea of the amount of work you will need to do to become profitable.

Setting your price can be a tricky thing to master; the way you work it out is going to be different if you are a service-based organisation to a product-based organisation, however as a starting point both involve calculating your breakeven point, which I will go through with you shortly.

The breakeven point is a level (in hours or units) where total income equals total expenses. Once you have reached the number of hours or units you will then be making a profit, if you do not sell enough to reach your breakeven point you will be trading at a loss, so it is a really useful calculation to do to give you an idea of the amount of work you will need to do to become profitable.

Service based businesses

For a service-based business the first thing to consider is how many hours you want to work and what income do you want to achieve? We can then put this into a breakeven formula to see what this would look like for your business. Once you have done your breakeven analysis (I will show you this shortly) and decided your potential price, you need to try and find out what your nearest competitors are charging so that you can make sure you aren’t out pricing yourself out of the market, or if you are going to be at a higher price to your competitors are your marketing materials clear about the extra or additional services or higher quality they will get to justify your price.

Product based businesses

For a product based business you need to work out what your costs of buying the product will be so that you can work out what the breakeven point is, and then as with a service based business find out what your competitors are charging. I’m not saying you should match your competitors price however if there is a recommended retail price (RRP) then that is a good starting point for testing the market, you can always move your price down or up.

With both service and product-based businesses remember your USP, as your USP can mean you can charge higher prices than your competitors.

With both service and product-based businesses remember your USP, as your USP can mean you can charge higher prices than your competitors.

Working out your break-even point:

To be able to work out your breakeven point you need to compile a list of the following costs:

Variable costs / direct costs are the costs per unit to buy a product or in a service-based business the hourly rate that you want to earn or have to pay sub-contractors. Direct costs go up or down in line with sales.

Variable costs per unit

Fixed costs / overheads are costs that you will have to pay whether you sell anything or not, i.e. they are costs that stay the same no matter how many products or services you sell. There are a few exceptions for example your travel costs and marketing costs are likely to be higher the more sales you make, however overheads aren’t normally directly related to making a sale.

Fixed costs/overheads per year

Variable costs / direct costs are the costs per unit to buy a product or in a service-based business the hourly rate that you want to earn or have to pay sub-contractors. Direct costs go up or down in line with sales.

Variable costs per unit

- Purchases/stock/materials/Subcontractor costs

Fixed costs / overheads are costs that you will have to pay whether you sell anything or not, i.e. they are costs that stay the same no matter how many products or services you sell. There are a few exceptions for example your travel costs and marketing costs are likely to be higher the more sales you make, however overheads aren’t normally directly related to making a sale.

Fixed costs/overheads per year

- Directors/owners salary/drawings

- Rent, rates, heat & light

- Motor expenses

- Travelling & subsistence

- Stationery, printing, postage

- Professional fees, legal, accountancy

- Repairs and maintenance

- Bank charges and finance costs

- Sundry

The Breakeven equation is:

Fixed Costs / (Sales Price - Variable Cost)

= Breakeven point in units/hours

Fixed Costs / (Sales Price - Variable Cost)

= Breakeven point in units/hours

A detailed example of how to calculate your break-even point can be found in our FREE Ebook

click here to download your copy